Online Casino Licenses in India – Learn Why Gaming Licenses Matter

Casino licenses are special credentials that prove the online casino is a legal entity and can operate in a given market. As such, the online casino licenses prove that you can join the licensed online casino and are guaranteed to join a legitimate, secure, safe, fair, and responsible entity.

So, you can say that casino licenses are essential for casino members, so you should join only licensed online casinos in India. Please read on as I’ve prepared a detailed guide on the importance of casino licenses and how to find licensed online casinos in India.

Top Licensed Online Casinos in India

Hands down, the best selection for Indian players!

Why are Casino Licenses Important?

An online casino license is necessary to offer casino games slots, casino games, lotteries, and sports betting from reputable online game providers. The casino license proves that the company has transparent services and has its services, like the RNGs, audited for optimal fair play. Also, casino licenses enable online casinos to operate within a given jurisdiction. Overall, online casino licenses are essential for the following factors:

- Regulation and Third-party Audits – legitimate casinos are regulated and get regular audits from third-party entities that ensure their games are fair.

- Game Variety – reputable online game providers only cooperate and provide their software to licensed online casinos. Also, licensed casinos proudly advertise their software providers and their available games.

- Online Safety and Security – legitimate casinos have active SSL/TLS certificates and adequate data encryption that ensures your online activity is safe and secure.

- Customer Support – a legitimate casino always offers quality customer support via several channels. Many of the best online casinos in India, like 20bet, even have 24/7 customer support.

How to Check an Online Casino License?

When it comes to finding an online casino license, this couldn’t be easier. All legitimate, licensed online casinos proudly present their online casino licenses on their website; most of these are links that take you to the licensing body’s website, where you can check the license yourself.

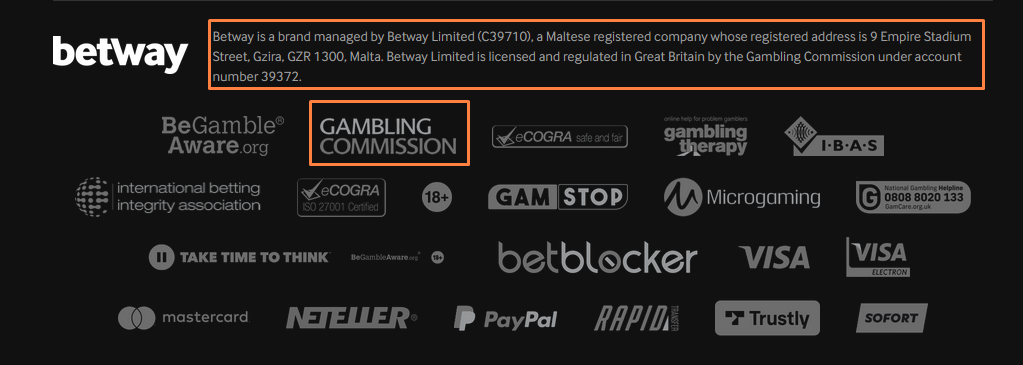

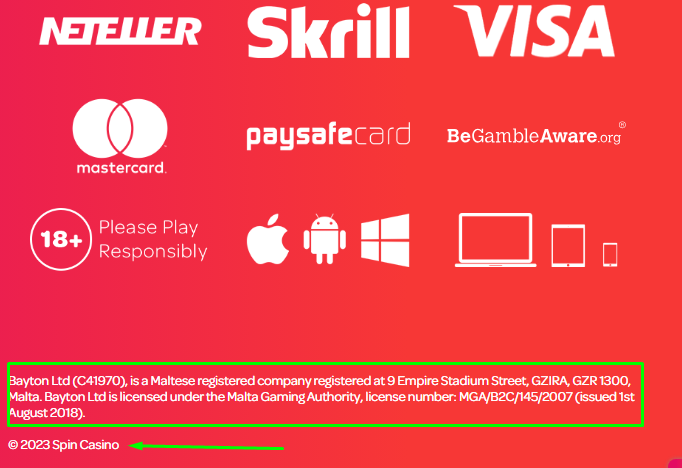

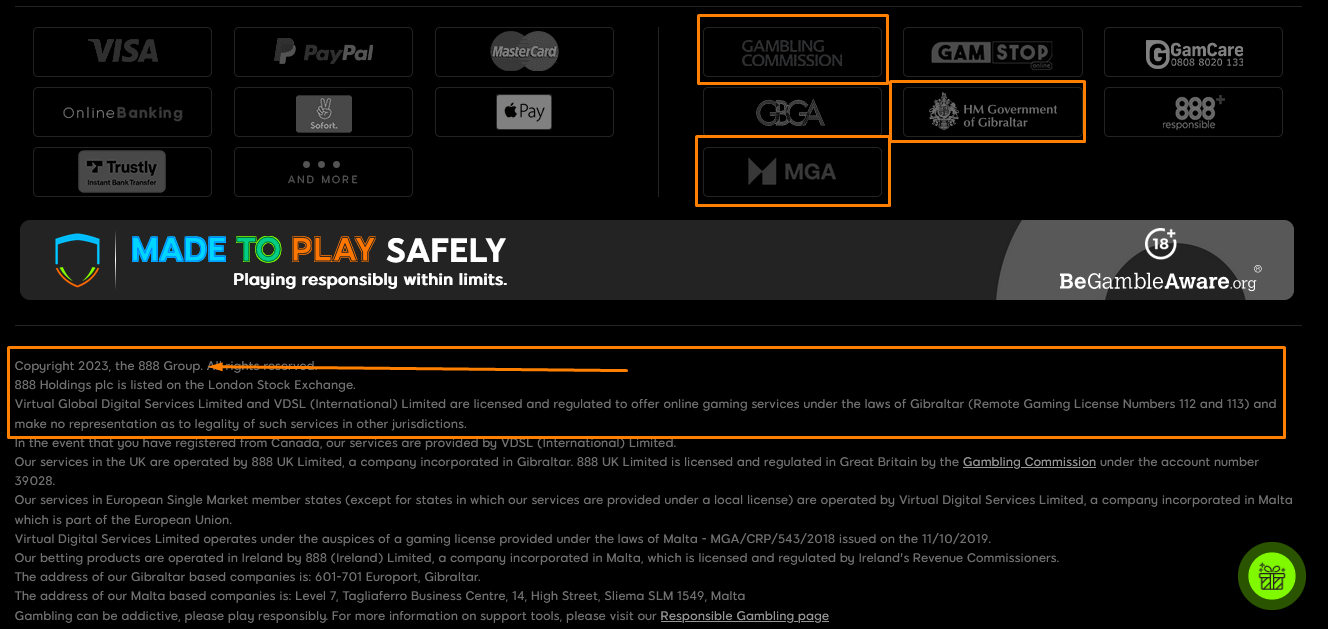

The following images show what you should be looking for when you go and check an online casino’s license:

What is the Difference Between Regulated and Licensed Casinos

Regulated online casinos are licensed and must adhere to specific rules set by the jurisdictions they are regulated by and the places they serve. The regulated casinos are also careful of the features they advertise and provide to their clients, as they have to answer to the regulatory bodies that regulate them. They usually have lower welcome bonuses and lower wagering requirements. Another important thing about the licensed and regulated casinos is that they have to get regular audits by third-party bodies, like eCOGRA, to check and ensure the fairness of the games and RNGs.

On the other hand, licensed casinos that are not regulated can legally operate in various jurisdictions, but they don’t have to answer to a regulatory body. It allows them to provide more significant bonuses and other perks they wouldn’t be able to if they had to answer to a regulatory body. For example, licensed but unregulated casinos can offer more significant welcome bonuses, but these usually come with higher wagering requirements.

International Casino Licenses

Various international casino licensing bodies operate worldwide; some are only for land-based casinos, and others work primarily in the online gaming industry. I’ve listed the most famous international casino licensing bodies whose licenses you’ll encounter at top online casinos in India, such as 10Cric:

- Curacao

A Curacao gaming license is the most common casino license with online casinos. It is because the Curacao eGaming Authority provides affordable licenses and certifications. The Curacao Gaming Control Board was established in 1996, issuing licenses valid for 5 years. The appeal of having a Curacao license is in the quick issuing of the license and the favorable tax laws on this Caribbean island. The average time to obtain an online casino license is about 6 weeks; the tax is 2% of the net gain.

- Malta

The Malta Gaming Authority, or MGA, is a world-renowned licensing body that issues online gambling licenses. The MGA was established in 2004, and it takes from 12 to 16 weeks for an online casino to get an MGA license, but it is valid for ten years. However, this license is very attractive, as it allows online casinos to provide services to unregulated markets, and they have to pay very low tax rates.

- United Kingdom

The United Kingdom Gambling Commission is a licensing and regulating body with strict rules that all licensed operators must adhere to. However, the UK Gambling Commission is also attractive because an online casino can provide services in the UK and many unregulated markets, such as the Indian market. The tax rules are friendly, and the overall conditions for the online casino are favorable. The process for obtaining a UKGC license takes about 16 weeks, but the licenses are permanently valid, which is a strong appeal for many online casinos.

- Gibraltar

Gibraltar is technically under British rule, but the UK laws don’t apply to gambling laws, and this island has separate gambling laws. These make it an appealing option for online casino licensing; the HM Government of Gibraltar has issued online gambling licenses since 1998. The time to obtain a license is between 12 and 24 months, and its validity is 5 years, but the tax rates in Gibraltar are very favorable at only 1%.

- Isle of Man

The Isle of Man is another island technically under British rule, but it has its own laws and regulatory body related to gambling. The Isle of Man has a separate Gambling Supervision Commission that started issuing online casino licenses in 2001 and provides different types of licenses. It takes about 12 to 16 to obtain a license from the Isle of Man’s GSC, and it is valid for 5 years, and online casinos have to pay a very low tax fee of 0.1 to 1.5% of the gross yield.

What are the Dangers of Playing at a Casino Without a License?

Unlicensed online casinos pose a threat to their members, and it is often without the member’s awareness. It is because these don’t have to adhere to the licensing bodies’ rules and regulations.

Often, unlicensed casinos disregard online safety and security measures, exposing the member’s personal and payment data to hackers. The quality of the games is relatively poor, as reputable game providers don’t allow their software to be used at online casinos without a proper license.

How to Find Licensed Casinos in India?

I do my best to test and review most online casinos in India, and I’ve found many that deserve to be on your list of online casinos to try. Before I share my suggestions, I need to share the selection criteria I use to find the best licensed casinos in India:

- Casino License – I first check the active casino license, which is essential for the overall safe, secure gambling experience.

- Design and navigation – the design should be excellent and the navigation intuitive to allow a broad range of users to join and play any game.

- Game variety – I check the game variety and only recommend online casinos with excellent games for Indians.

- Game providers – the top licensed casinos have casino games from reputable game providers that ensure a proper gambling experience.

- Deposit & withdrawal methods – the FEMA Act limits Indians to using INR for online payments, so a good, licensed casino in India should have all the Indian-favorite payment methods.

- Mobile use – a good online casino should have a good desktop and an excellent mobile casino app to appeal to a broad range of players.

- Bonuses – casino bonuses are great for new players, and licensed casinos provide valuable bonuses with reasonable wagering requirements.

- Customer support – licensed online casinos have quality customer support and several channels you can reach them.

FAQs

Is it safe to play online casinos in India?

India is an unregulated market, and the Indian laws don’t mention online gambling, making it legal to play at an online casino in India. However, the only way to ensure a safe online experience is to join a licensed online casino in India, like 10Cric, 888Casino, Betway, 22Bet, Spin Casino, or 1xBet.

Why does a casino need a gambling license?

A casino needs a gambling license to prove they are a legitimate platform that provides a safe and secure gambling experience. Also, a casino license allows the casino to accept players from various jurisdictions.

What is the risk of playing at an unlicensed casino?

Playing at an unlicensed casino can be risky because of poor safety and security measures, data encryption or server safety, payout guarantees, lack of customer support, poor game selection, etc.

What are the requirements for a gaming license?

An online casino must fill out the requirements for obtaining a gaming license: a useful website, financial statements, and guarantees, insurance policies, a certificate of incorporation for the company, a merchant account, and other documents.

What is the best casino license?

Some of the best online casino licenses are Curacao, the UK, and Malta gambling licenses, as these allow online casinos to accept players from different jurisdictions but also have strict rules regarding user experience and online safety. The best Indian online casinos I recommend to you: 10Cric, 888Casino, Betway, Spin Casino, 1xBet, 22Bet, 20Bet, and JackpotCity; all have casino licenses from one of these licensing bodies.